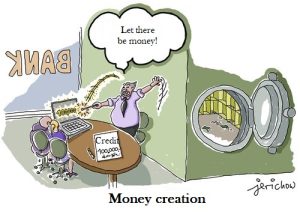

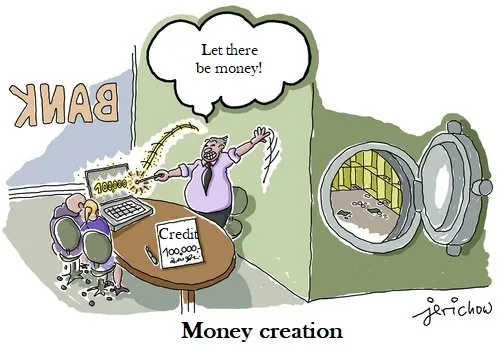

What do growing debt and the way money enters the world have in common?

90%

of money is created by banks out of thin air

90%

of which is used for speculation

90%

of the population does not know these facts...

In 2012 in Frankfurt, a survey with a thousand citizens asked the question: “Who makes and distributes money? The vast majority of respondents thought that either the central bank or the government put the money into circulation and decided who got it. But what does private debt, for example, have to do with the financial system?

This is the reality

Banks create new money when they make loans. Before the loan, this money did not exist. 97% of the money in today’s economy exists as bank deposits, while only 3% is physical cash. The money that banks create is not the paper money that bears the logo of the European Central Bank. It is the electronic deposit money that lights up on the screen when you check your balance at an ATM. Currently, this money accounts for over 97% of all money in the economy. Only 3% of the money is still in this old-fashioned form of cash that you can touch.

This is confirmed by the Central Bank of: Great Britain, Germany and many other European central banks!

Do you think it is right for the commercial banks to do this? Because there is no law that authorises them to do so!

What is one of the negative side effects for the environment of this illicit activity? The failure of a bank is not due to new circumstances, but, like every banking crisis, has the same cause over and over again! Banks lend far more than they have deposits. These loans, in turn, go most often for non-productive and also very profitable purposes, such as oil pipelines, chemical factories for pesticides, technologies for genetically modified plants or simply speculation with food. As soon as one of the deals goes wrong, it becomes public sooner or later. Customers start withdrawing their (real) money. Liquidity deteriorates. The crash accelerates as more and more people find out about it. The bank run is inevitable….

The banks do not only generate new money by:

- Loans but also through

- Payouts of wages and bonuses,

- Purchase of real estate and

- Other assets

And what else is bad about it? The interest and compound interest effect. The borrower has to pay the interest, in return for which he either has to increase production or put other competitors out of business in fierce competition. The debt avalanche rises. The interest rate effect increases exponentially and this is not compatible with the finite resources of our earth. E.g. indebted states easily get into a debt spiral when the national debt rises above 50% of the gross national product. When the debt can no longer be repaid and only interest can be paid, one is caught in a debt trap. But can debts keep growing and growing? No, because at some point the possibilities of the debtors are exhausted, even the possibilities of the largest and last debtor – the state. It is the same with private debts, the last step is private insolvency.

In our view, this is the ultimate driver of the problem.

The question is, what will collapse first, society, the earth or the financial system?

Watch this film

Act now and sign the petition!

Image: jerichow