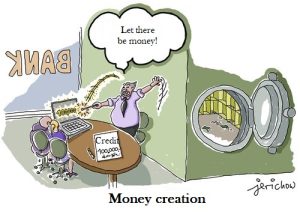

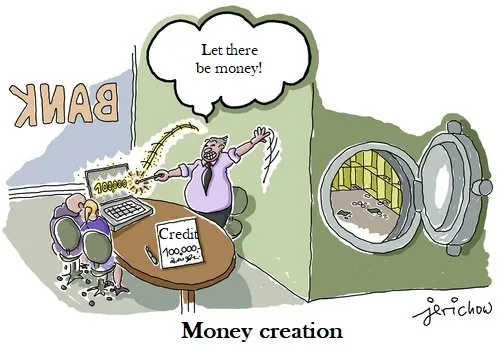

How does money come into the world and what is the sovereign money reform?

90%

of money is created by banks out of thin air

90%

of which is used for speculation

90%

of the population does not know these facts...

In 2012 in Frankfurt, a survey of a thousand citizens asked the question: “Who makes and distributes money? The vast majority of respondents thought that either the central bank or the government put the money into circulation and decided who got it. But what do unemployment and fear of losing one’s job have to do with it?

This is the reality

Banks create new money when they make loans. Before the loan, this money did not exist. 97% of the money in today’s economy exists as bank deposits, while only 3% is physical cash. The money that banks create is not the paper money that bears the logo of the European Central Bank. It is the electronic deposit money that lights up on the screen when you check your balance at an ATM. Currently, this money accounts for over 97% of all money in the economy. Only 3% of the money is still in this old-fashioned form of cash that you can touch.

This is confirmed by the Central Bank of: Great Britain, Germany and many other European central banks!

Do you think it is right for the commercial banks to do this? Because there is no law that authorises them to do so!

What is one of the negative side effects for the environment of this illicit activity? The failure of a bank is not due to new circumstances, but, like every banking crisis, has the same cause over and over again! Banks lend much more than they have deposits. These loans, in turn, go most often for non-productive and also very profitable purposes, such as oil pipelines, chemical factories for pesticides, technologies for genetically modified plants or simply speculation with food. As soon as one of the deals goes wrong, it becomes public sooner or later. Customers start withdrawing their (real) money. Liquidity deteriorates. The crash accelerates as more and more people find out about it. The bank run is inevitable….

Even worse, the banks pay themselves bonuses from the newly created money, buy real estate and other expensive objects (e.g. yachts). And what else is bad about it? The banks have no costs at all in “printing money” because everything is electronic. There is an enormous overreaching in favour of the banks, and within the banks in favour of the top management or the shareholders. A concentration of capital in the hands of a few people promotes social inequality in an extreme way.

The solution: a sovereign money reform creates real competition

The banks will be deprived of the privilege of producing their own money. They will thus once again be put on an equal footing with all other companies. They can then only work with the money that is made available to them by savers, other banks or, as far as necessary, by the National Bank. If the savers’ deposits are not sufficient for lending, the National Bank can make loans available to the banking system.

With sovereign money, all credit balances on our payment accounts become legal tender, electronic cash, so to speak. If a bank goes bankrupt, the euros in private accounts are no longer lost. They now really belong to the money owner – just like the cash in the wallet or safe. This money is therefore completely safe. Banks no longer have to be rescued by the state: a huge gain in security for our national economy.

Sovereign money promotes the traditional and solid banking business. Banks can also operate profitably and stably in the long term with sovereign money. Jobs in the banking industry remain secure. This is shown by various examples: Insurance companies and other financial enterprises work profitably without producing money themselves.

The cooperative Raiffeisen banks are also already functioning more or less according to the sovereign money system, because the savings deposited with them roughly correspond to the volume of outstanding loans. Raiffeisen banks, but also many savings banks and most alternative banks will hardly notice the conversion to sovereign money. And the numerous small asset management banks won’t anyway, because they already operate a business model that is independent of financing.

Banking regulation can be fundamentally simplified. Instead of fighting the symptoms with more and more laws and regulations, the problem is finally tackled at its root. Sovereign money thus makes it possible to reduce bureaucracy in the banking system. This becomes a locational advantage for the European financial centre in global competition.

In our view, this is the ultimate driver of the problem.

The question is, what will collapse first, society, the earth or the financial system?

Watch this film

Act now and sign the petition!

Image: jerichow