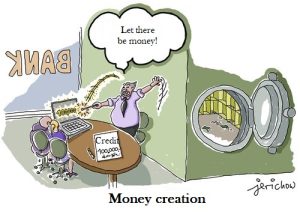

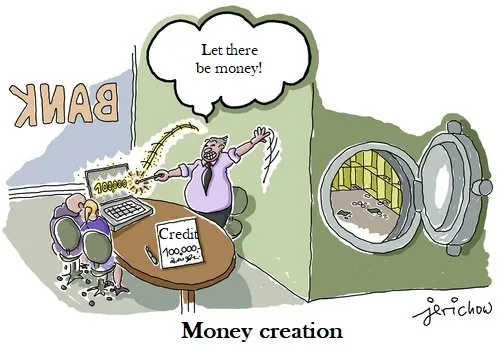

What do the growth imperative and the way money enters the world have in common?

90%

of money is created by banks out of thin air

90%

of which is used for speculation

90%

of the population does not know these facts...

In 2012, a survey of 1,000 citizens in Frankfurt asked: “Who makes and distributes the money? The vast majority of respondents thought that the central bank or the government put the money into circulation and decided who gets it. But what does the growth imperative have to do with it?

This is the reality

Banks create new money when they lend. Before lending, this money did not exist. 97% of the money in today’s economy exists as bank deposits, while only 3% is physical cash. The money that banks create is not paper money bearing the logo of the European Central Bank. It is the electronic deposit money that lights up on the screen when you check your balance at an ATM. Today, this money accounts for more than 97% of all money in the economy. Only 3% of the money is still in this old-fashioned form of touchable cash.

This is confirmed by the Central Bank of: Great Britain, Germany and many other European central banks!

Do you think it is right for commercial banks to do this? Because there is no law authorising them to do so.

What is one of the negative environmental side effects of this illegal activity? The failure of a bank is not due to new circumstances, but, like all banking crises, it has the same cause over and over again! Banks lend far more than they have in deposits. These loans, in turn, are most often used for non-productive and also very profitable purposes, such as oil pipelines, chemical factories for pesticides, technologies for genetically modified plants or simply food speculation. As soon as one of the deals goes wrong, sooner or later it becomes public. Clients start withdrawing their (real) money. Liquidity deteriorates. Bankruptcy accelerates as more and more people find out. The bank run is inevitable….

What else is wrong with it? Interest and the effect of compound interest. The borrower has to pay the interest, in return for which he has to increase production or put other competitors out of business in fierce competition. The avalanche of debt increases. The interest rate effect increases exponentially and this is not compatible with the finite resources of our earth. To continue to exist, the borrowing company must continue to grow. And then we come to the compulsion to grow…..

In our view, this is the ultimate driver of the problem.

The question is, what will collapse first, society, the earth or the financial system?

Watch this film

Act now and sign the petition!

Image: jerichow