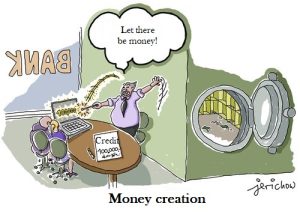

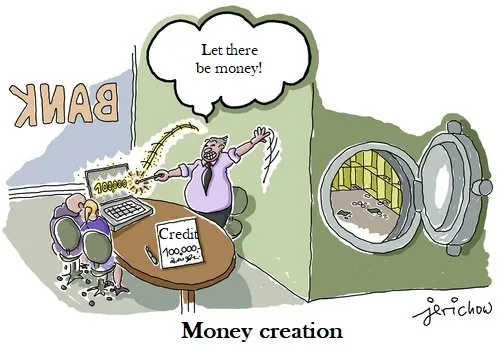

What do unemployment and the way money comes into the world have in common?

90%

of money is created by banks out of thin air

90%

of which is used for speculation

90%

of the population does not know these facts...

In 2012 in Frankfurt, in a survey with a thousand citizens, the question was asked: “Who makes and distributes money? The vast majority of respondents thought that either the central bank or the government put the money into circulation and decided who got it. But what do unemployment and fear of losing one’s job have to do with it?

This is the reality

Banks create new money when they make loans. Before the loan, this money did not exist. 97% of the money in today’s economy exists as bank deposits, while only 3% is physical cash. The money that banks create is not the paper money that bears the logo of the European Central Bank. It is the electronic deposit money that lights up on the screen when you check your balance at an ATM. Currently, this money accounts for over 97% of all money in the economy. Only 3% of the money is still in this old-fashioned form of cash that you can touch.

This is confirmed by the Central Bank of: Great Britain, Germany and many other European central banks!

Do you think it is right for the commercial banks to do this? Because there is no law that authorises them to do so!

What is one of the negative side effects for the environment of this illicit activity? The failure of a bank is not due to new circumstances, but, like every banking crisis, has the same cause over and over again! Banks lend far more than they have deposits. These loans, in turn, go most often for non-productive and also very profitable purposes, such as oil pipelines, chemical factories for pesticides, technologies for genetically modified plants or simply speculation with food. As soon as one of the deals goes wrong, it becomes public sooner or later. Customers start withdrawing their (real) money. Liquidity deteriorates. The crash accelerates as more and more people find out about it. The bank run is inevitable….

Even worse, the banks pay themselves bonuses from the newly created money, buy real estate and other expensive objects (e.g. yachts). And what else is bad about it? The banks have no costs at all in “printing money” because everything is electronic. There is an enormous overreaching in favour of the banks, and within the banks in favour of the top management or the shareholders. A concentration of capital in the hands of a few people promotes social inequality in an extreme way.

The emergence of unemployment

More than 80% of the loans given by the banks are not for productive purposes, but for speculative ones, because there is more money to be made there. Only the small remainder goes for productive purposes, e.g. for medium-sized enterprises that want to improve their production. With this credit, the bank earns less. The real, producing enterprises do not get enough capital, consequently they cannot hire enough people. Worse, they have to lay off at every little economic slump.

I.e. the banks create the money themselves and even lend it for the wrong purposes! This is one of the reasons that fewer jobs and apprenticeships are being created for the young, that older people are being laid off earlier and that there is fear for the job!

In our view, this is the ultimate driver of the problem.

The question is, what will collapse first, society, the earth or the financial system?

Watch this film:

Act now and sign the petition!

Image: jerichow