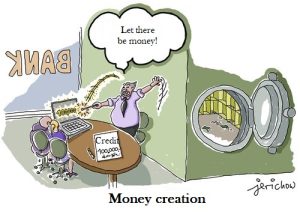

What do the planned digital euro and the way money comes into the world have in common?

90%

of money is created by banks out of thin air

90%

of which is used for speculation

90%

of the population does not know these facts...

In 2012 in Frankfurt, in a survey with a thousand citizens, the question was asked: “Who makes and distributes money? The vast majority of respondents thought that either the central bank or the government put the money into circulation and decided who would receive it. But what does the planned (from around 2026) digital euro have to do with it?

This is the reality

Banks create new money when they make loans. Before the loan, this money did not exist. 97% of the money in today’s economy exists as bank deposits, while only 3% is physical cash. The money that banks create is not the paper money that bears the logo of the European Central Bank. It is the electronic deposit money that lights up on the screen when you check your balance at an ATM. Currently, this money accounts for over 97% of all money in the economy. Only 3% of the money is still in this old-fashioned form of cash that you can touch.

This is confirmed by the Central Bank of: Great Britain, Germany and many other European central banks!

Do you think it is right for the commercial banks to do this? Because there is no law that authorises them to do so!

What is one of the negative side effects for the environment of this illicit activity? The failure of a bank is not due to new circumstances, but, like every banking crisis, has the same cause over and over again! Banks lend much more than they have deposits. These loans, in turn, go most often for non-productive and also very profitable purposes, such as oil pipelines, chemical factories for pesticides, technologies for genetically modified plants or simply speculation with food. As soon as one of the deals goes wrong, it becomes public sooner or later. Customers start withdrawing their (real) money. Liquidity deteriorates. The crash accelerates as more and more people find out about it. The bank run is inevitable….

Even worse, the banks pay themselves bonuses from the newly created money, buy real estate and other expensive objects (e.g. yachts). And what else is bad about it? The banks have no costs at all in “printing money” because everything is electronic. There is an enormous overreaching in favour of the banks, and within the banks in favour of the top management or the shareholders. A concentration of capital in the hands of a few people promotes social inequality in an extreme way.

What is a digital euro?

Today, citizens primarily have the choice between two types of money in so-called public transactions:

physical cash and digital giro money. Cash is issued by the central bank, secures anonymous payments, is the only legal tender and is safe in banking crises. Giral money, i.e. digital money in citizens’ current accounts, is in turn produced by private commercial banks, is not a legal tender and is not safe in banking crises. Digital central bank money (CBDC) would thus for the first time be digital money from the central bank that can also be used by non-banks. However, the discussion about a CBDC has so far primarily involved actors from central banks and commercial banks. The perspective of civil society is thus neglected.

We therefore call for the digital euro:

1. every citizen in the euro area must have the right to acquire and hold it. As with cash, it must be just as easily accessible.

2. the amount per person is not limited (in the medium and long term) and can be exchanged for cash at any time.

3. as it is advertised as an alternative to cash, it must also provide the same level of privacy protection.

4. this is not so-called “programmable money”. It may not be restricted for certain payments, e.g. for food or other goods, or only activated for people with certain behaviour.

5. cash must not be further restricted as a consequence of the introduction of the digital euro.

6. this is legal tender like cash and must result in an acceptance obligation.

7. like cash, it yields no interest, positive or negative.

In our view, this is the ultimate driver of the problem.

The question is, what will collapse first, society, the earth or the financial system?

Watch this film

Act now and sign the petition!

Image: jerichow